SHARE

Supercharge your under performing retention program using advanced machine learning

It might sound like science fiction, but present-day artificial intelligence (AI) technology—specifically, advanced machine learning—can improve your retention rate. Machine learning, the current state-of-the-art tech in the AI field, can predict churn (attrition rate) at a company-wide level and at an individual level. With an intelligent retention system, you can slow down and prevent distributor exits from your organization. To demonstrate how, I’ll draw on standard industry practices, statistics, and my own personal experience implementing an intelligent retention program.

Churn is unavoidable, but not unaddressable

Your churn rate is the number of distributors who cut ties with your company during a given timeframe. In this business, we know that churn is inevitable. Distributors will leave, no matter how sophisticated the retention system is. Awareness of the inevitability can make us feel like there’s nothing to be done but that line of thinking is a mistake. We can’t stop attrition entirely, but we can mitigate its effect on the bottom line.

Churn affects the bottom line in several ways. Here are a few stats about the impact of customer loss:

- It cost 5–25 times more to acquire new customers than to keep current ones. (Harvard Review)

- The probability of selling to an existing customer is 60–70%. The probability of selling to a new prospect is 5–20%. (Market Metrics)

- On average, loyal customers are worth up to 10 times more than the value of their first purchase. (White House Office of Consumer Affairs)

These statistics are for customers. When we talk about churn in multilevel marketing, we’re talking about distributors with downlines. When a distributor leaves, they might take their entire organization with them. Dollar-for-dollar, investment in retention can go much further than investment in new sales alone.

Help them before the cancellation call

It seems that many companies think of retention as a plan for what to do when a distributor calls to cancel their membership—a policy that allows customer service to pause auto-ship programs, or offer free shipping or free product. But if a distributor is calling to cancel, it’s already too late.

The key to increasing retention is to identify and reach out to your at-risk distributors before they’ve decided to leave.

An Ounce of Prevention Prediction

It’s been said that the best defense is a good offence and an ounce of prevention is worth a pound of cure. But how do you proactively retain at-risk distributors when you don’t know who they are until it’s too late? Predictive analytics, a type of advanced machine learning that sifts through distributor data looking for hard-to-detect behavior patterns—patterns that would be lost on human eyes. If you apply predictive analytics to your retention program, you will be able to detect at-risk distributors, identify optimal interventions, and apply those interventions at critical moments in their distributor-journeys.

So where do we start?

Defining benchmarks

In any retention program, your success is only as good as the accuracy of your benchmarks. If you don’t know how long an average rank 5 stays with your organization, you’ll either waste resources fighting against reality, or you’ll give up too soon. With predictive analytics, you can develop benchmarks based on the historical purchasing behavior of your own unique distributor force—not on general industry averages.

I’ve found two benchmarks that, if accurate, give clear guidance on measuring and improving retention:

Average rank lifespan. The length of time you can expect a distributor at a given rank to stay with the company.

Lifetime value factor. The volume generated by a distributor and their organization over the duration of their membership with the company if they reach their average rank lifespan.

To identify these benchmarks, the first step is to get your historical sales data into the hands of your machine learning team. After your machine learning team feeds the system your data, the system will learn the average lifespan of each rank, as well as the unique factors leading to a longer- or shorter-than-average rank lifespan. I call this process rank aging.

Some of the common factors that affect rank aging are:

- Rank advancement speed

- Average earnings at the current rank

- Month of enrollment

- The starter pack cost

- The rank/level of the distributor who enrolled them

Lifetime value factor

Once you know an individual distributor’s expected lifespan and their lifetime value factor, you can calculate the value lost over a shorter-than-average lifespan. I’ll work through an example to demonstrate how this works.

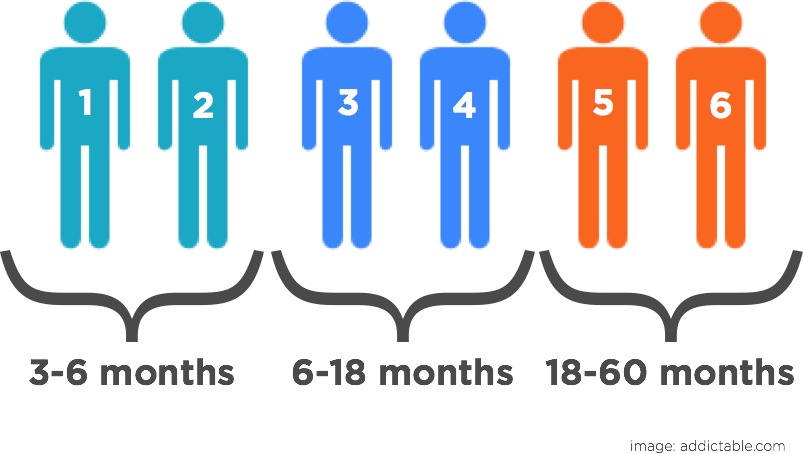

For this example, ranks have to be earned (not bought) and the compensation plan is a unilevel in which distributors at the same rank receive the same commission rate. Let’s assume the system learned that the average lifespan of ranks 1 and 2 is 3–6 months, ranks 3 and 4 is 6–18 months, and 5 and 6 is 18–60 months.

Enter Bob.

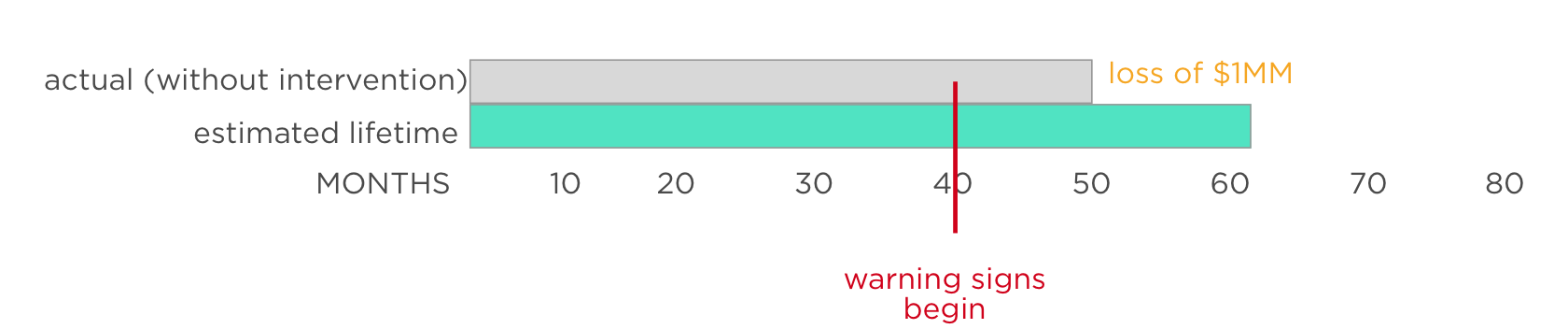

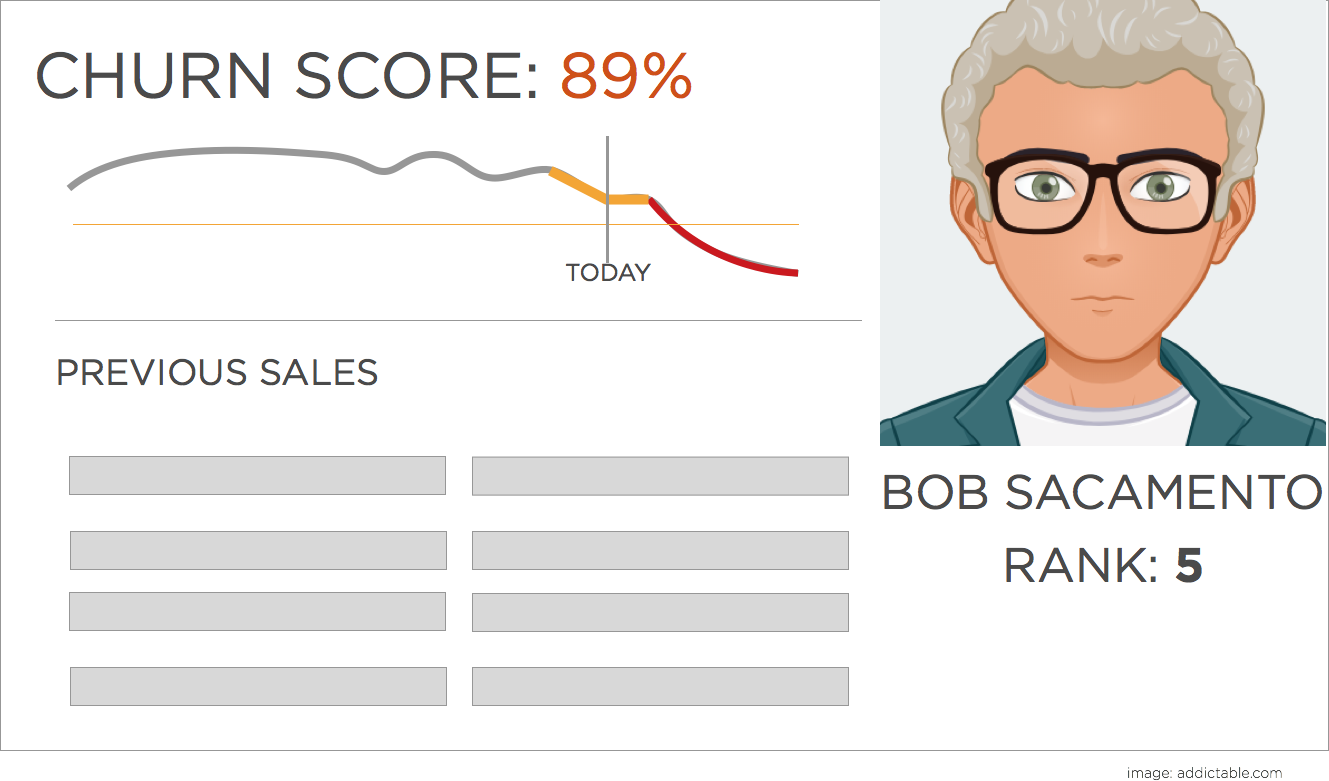

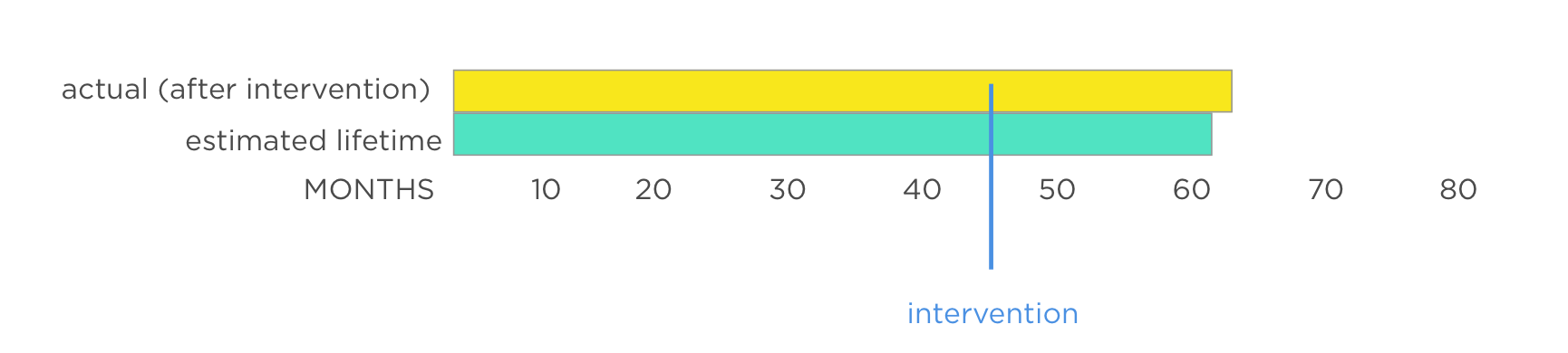

Bob is a rank 5 who has been with the company for 40 months. According to our intelligent retention system he should stay for 60 months. But, Bob is at risk. If he doesn’t receive an intervention within the next 6 months, there’s an 89% chance he’ll churn 10 months early, at month 50.

Not a big deal, right? It’s only 10 months.

That’s where lifetime value comes in.

Bob’s personal sales vary, but his downline volume is $100,000 in sales per month. If Bob falls short of his lifetime value by leaving 10 months early with his downline, it will cost the company around $1,000,000 in sales. Suddenly those short 10 months are a much bigger deal. Of course, if you didn’t have a good benchmark for rank 5 lifespans or an understanding of Bob’s lifetime value factor, $1,000,000 could leave the organization unnoticed.

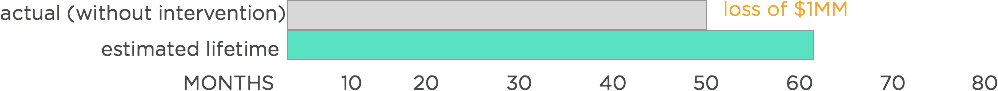

Bob’s anticipated lifetime as a distributor is 60 months.

Without an intervention, Bob will churn 10 months early. If his downline leaves with him, this exit will cost ~ $1MM.

But how do you know when a distributor is thinking of leaving? Start by figuring out their churn score—the likelihood of an individual distributor churning within a given timeframe.

Churn score

To calculate churn scores, begin by scouring the data you already have. Create early-detection models & algorithms based on your existing sales data. Train your intelligent retention system to spot churn-preceding nano-patterns in the behavior of past distributors. As you continue to feed the retention system monthly sales data, its understanding of the correlation between specific actions and future behavior will increase.

Machine Learning can detect when pre-churn begins.

As your intelligent retention system learns to detect behavior that precedes churn, it can score each distributor on the likelihood of them churning within a given timeframe. This is your distributor’s churn score.

Intervention

When customer service takes a call, make sure they have the caller’s churn score in front of them. Empower your reps to give extra service to callers with high churn scores. Record what action your phone rep took—if they offered a promotion, free shipping, free product, or extra time and personal attention over the phone—and feed that data back into the system. If you record what you do, the system can learn what works.

Adding a churn score to customer profiles helps ensure they get the right intervention at critical times.

In Bob’s scenario, let’s assume that he calls customer service at month 45 to ask a question about an order. If Bob’s churn score appears on the screen, the customer service representative will know it’s important to ensure that this customer is happy with the company. Sometimes, it’s as simple as offering free shipping or 10% off. If this intervention is successful, you’ll know within weeks. Your intelligent retention system will see good signs, Bob’s churn score will reduce, and he’ll continue with the company for at least as long as the average rank 5.

An intervention at the right time can make all the difference.

If you’re lucky, this could lead Bob to a new wave of momentum or an eventual rise in rank. If nothing else, it turns a losing situation into a winning one.

Remarkability comes at a cost: patience

Machine learning for retention is great, but it requires patience. You didn’t jump to college right out of kindergarten; you needed time to learn and grow. Your predictive system needs the time to learn about your unique distributor force before it can isolate the tell-tale signs of their future behavior. The more data you feed it, the more it will learn.

Some people in your organization will want to have a complete, detailed explanation of why one distributor got a higher score than another. It’s a request you’ll want to be ready for though the answer might not satisfy them. From the perspective of a human looking at the data, these members should have the same score. But the machine learning technology looked at thousands of data points, found relevant patterns that a human would miss, and weighed them accordingly. The system is gathering insights you can’t detect on your own—that’s the point! Only time will prove the system’s accuracy.

Let me ask you a question: when you take your first ride in a fully self-driving car, which seat will you sit in? The back seat or the driver’s seat? Chances are you’ll start in the driver’s seat, ready to take over if the system fails. But as you come to trust the technology, you’ll move to the back seat where you can relax and focus on something other than the road.

Gather your data, feed it to the system, give it time to learn, watch it closely until it has proven its accuracy, and then trust the findings. The benefit to your business will speak for itself and you’ll fly from churn to earn.

you may also like

Essential Software Customizations for MLM, Direct Selling, and Affiliate E-commerce

Navigating the changing landscape of e-commerce, particularly within MLM, direct selling, and affiliate marketing channels, requires more…

How to Ensure Your Compensation Plan and Software Work Well Together

Peanut butter and jelly. Milk and cookies. Batman and Robin. Everybody knows these famous pairings work well…

Podcast 53: Advantages Using an Interim VP of Sales for Direct Selling Companies

Today we welcome a returning guest of this podcast: Jeff Jordan. Jeff has also written articles for…

compensation consulting for mlm companies

We offer data-driven compensation plan design & analysis

MLM.com Newsletter

Get our e-mail newsletter, with MLM.com articles & online exclusives, delivered to your inbox each week.