SHARE

What’s a Binary Compensation Plan?

The binary compensation plan is the newest of the three common plan types. When it arrived on the industry scene, this type of plan was the complete opposite approach to commissions than existing plans. The difference was night and day. Before the binary emerged, every other compensation plan relied on the following two premises:

- The plan pays commissions on a limited number of levels of a distributor’s downline, but on an unlimited amount of sales volume.

- For a given product order, the plan pays all commissions in a single commission run.

In contrast, the binary plan relies on the following two opposite premises:

- The plan pays commissions on an unlimited number of levels of a distributor’s downline, but on a limited amount of sales volume.

- For a given product order, the plan can pay commissions across several commission runs, and in fact, it’s impossible to know when the plan has paid all the commissions on a single order.

This represents quite a break from the traditional way of doing business. But this plan survived the test of time to become one of the dominant compensation plan types in the MLM industry.

How does a binary compensation plan work?

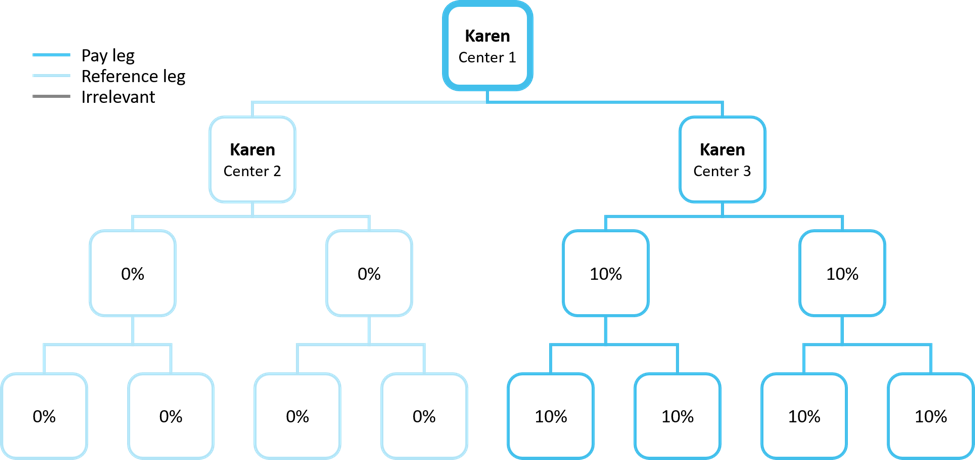

A binary compensation plan uses a limited-width structure that restricts distributors to two first-level recruits, creating two downline legs. A leg is a portion of a distributor’s organization starting with one of his or her first-level distributors and encompassing that first-level distributor’s entire organization. Let’s look at Karen’s organization.

One leg is Karen’s strong leg (the leg with more volume, also known as her reference leg) and the other is her weak leg (the leg with less volume, also known as her pay leg). These labels aren’t permanent, they’re practical. If her weak leg grows and surpasses her strong leg in volume, it becomes her strong leg.

A binary compensation plan does not pay on levels like other plans, but on the sales volume of the weak leg. The plan pays Karen 10% on her weak leg, so if her two legs are close to each other in volume, she’s getting roughly 5% of her entire organization’s volume. With a binary plan, depth really doesn’t matter, because these plans pay distributors on their volume all the way to the bottom of the tree. What matters is the balance of sales volume between the legs.

Binary compensation plan basics

- A distributor sponsors two people, creating two downline legs, and then builds a downline under each of those two legs.

- Some binaries allow distributors to have multiple business centers—usually three or seven.

- Traditionally, binaries pay their downline commissions once a week, however, some still pay monthly.

- Distributors must balance the downline sales volume they generate between the two downline legs. When individuals reach specific levels of sales volume, they receive a commission check.

- Distributors can accumulate sales volume in one week or across several pay periods. In this respect, binary compensation plans are unique. Most plans pay a distributor on whatever volume they accumulate in one pay period. If they don’t accumulate enough to earn a commission, that money is simply lost—they will never earn commissions on it. With a binary, a distributor can accumulate volume for several pay periods. When they accumulate enough to qualify, they earn that commission—binary has that cumulative effect. For example: If a distributor must earn $500 in volume to qualify for a commission, but accumulates only $100 per pay period, then on the fifth pay period—Bingo! They get that commission.

The challenge with a binary plan is trying to keep both legs balanced. If you get $100,000 on one side and $10,000 on the other side, then you’re going to earn on the $10,000. If you have $100,000 on one side and $99,000 on the other side, you’re going to earn on the $99,000. However, today a popular variation of this plan splits the volume 1/3-2/3.

Most binary plans pay a weekly pool commission. A distributor has two first-level distributors who must each generate an amount of sales volume. The company puts aside an amount of money in a pool and then divides it up among those who qualify.

What are multi-center trees?

A multi-center tree is a concept that allows a distributor to have more than one position in the downline tree. Having more than one business center means having more than one pay leg. And in some cases, it means earning a commission twice on the same volume.

Companies implement multi-center trees in two ways:

- After distributors succeed in filling in their original matrix, they can have a new business center in the tree and build a new downline from that center.

- The company creates all of the business centers at the time of the distributor’s enrollment, and places the distributor’s entire downline under these multiple business centers.

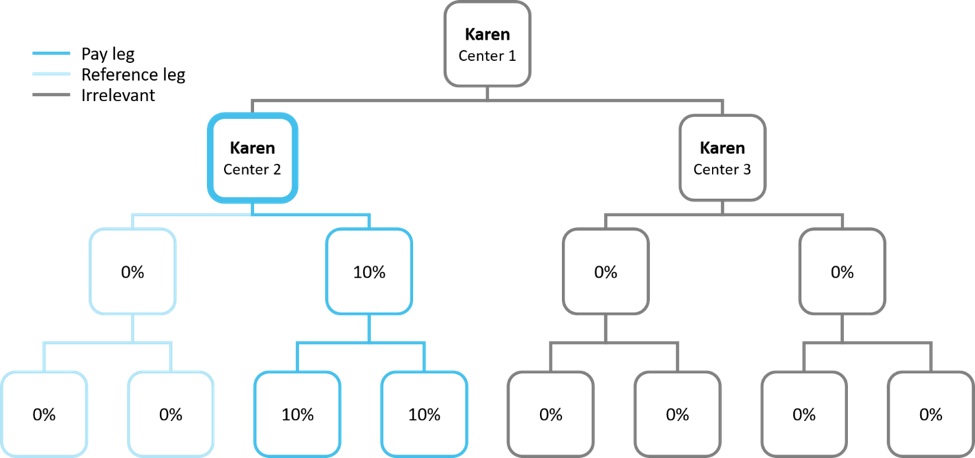

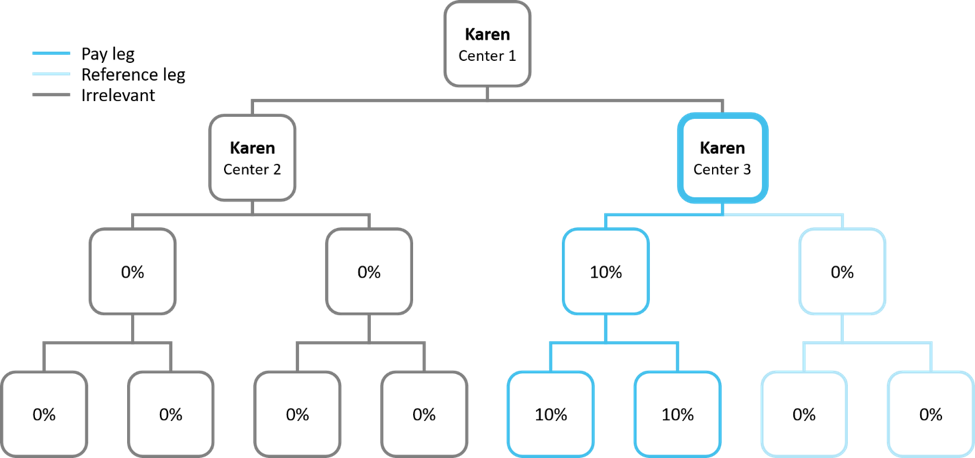

If Karen gets three business centers at the time of her enrollment, her second and third center go directly below her first center, so they constitute the tops of each of her first center’s legs. Here’s a visual representation of that, breaking it down by the payout for each business center.

In this example, Karen’s first center gets a 10% commission on all the volume under her third center. Her second center is the top of her reference leg, so her first center doesn’t earn on its volume, but the second center itself gets 10% on the weak leg of the organization beneath it.

Her third center also earns on its pay leg which constitutes half of her first center’s pay leg. In other words, she earns 10% on her third center’s pay leg, and another 10% on the same volume because it’s also in her first center’s pay leg.

The total payout looks like this:

Again, she earns on all her volume except that generated in her second center’s reference leg and she earns twice on her third center’s pay leg.

What’s the “cap”?

A typical binary compensation plan would specify that if a distributor has at least $500 in volume on the weak leg, they would receive 10% of their weak leg in commission. However, one of the rules of almost all binaries is that they have a payout cap of somewhere between 40 and 50%. This means that if a company adds up all of its commission payments and the total exceeds the payout cap, the company has to reduce everyone’s payment proportionally to keep the total payout below this cap. We call this scenario hitting the cap. All binaries hit the cap, so it’s is important to be familiar with this feature.

Example

If a company:

- Has a 50% payout cap to limit payout to no more than 50% of sales

- Makes $1 million in sales

It should pay out $550,000 in commissions, which is 10% over the set cap. Instead of doing that, the company will reduce everyone’s commissions by 10% in order to stay below the payout cap. Distributors get only 90 cents on every dollar.

Strengths of binary compensation plans

- The initial selling feature of the binary compensation plan was that it was much easier for distributors to understand and maintain qualifications than other plans of the day. What could be simpler? A distributor sponsors two people and builds those two legs. If those legs generate business, the distributor receives commissions. If they generate a lot of business, the distributor makes a lot of money! Of course, when something sounds too good to be true, it usually is, and binary plans turned out to be more complex than they seemed.

- Volume never moves out of a distributor’s payline no matter how many levels deep their genealogy goes.

- The binary does an excellent job of paying mid-range commissions. This is its strength and probably the reason it has survived. On the other hand, it does not do well on very low-end commissions or high-end commissions.

- The binary compensation plan’s behavior is very well understood.

Weaknesses of binary compensation plans

- Many of the original binaries promised distributors that their upline would build their downline. This created a welfare mentality.

- Most binaries have a maximum upper limit on earnings—the payout cap. Some distributors don’t realize this. However, combining binaries with other commission types can fix this capped earnings problem.

- Binary pays well but distributors sometimes struggle with the structure aspects of the plan.

Summary

Distributors seem to either love binary compensation plans or hate them. These plans inherently reward salespeople and sales leaders better than almost any other type of plan. They pay well, but distributors can find the structure challenging to deal with. It is a big plus that distributors no longer have to evenly balance the volume of the two legs. Binaries can maximize their success by combining the base commission with other types of commissions.

Want help designing a binary compensation plan? Reach out to us at MLM Compensation Consulting. We offer data-driven compensation plan design and analysis.

you may also like

Essential Software Customizations for MLM, Direct Selling, and Affiliate E-commerce

Navigating the changing landscape of e-commerce, particularly within MLM, direct selling, and affiliate marketing channels, requires more…

How to Ensure Your Compensation Plan and Software Work Well Together

Peanut butter and jelly. Milk and cookies. Batman and Robin. Everybody knows these famous pairings work well…

Podcast 53: Advantages Using an Interim VP of Sales for Direct Selling Companies

Today we welcome a returning guest of this podcast: Jeff Jordan. Jeff has also written articles for…

compensation consulting for mlm companies

We offer data-driven compensation plan design & analysis

MLM.com Newsletter

Get our e-mail newsletter, with MLM.com articles & online exclusives, delivered to your inbox each week.